Investing in Real Estate Wholesaling: An Overview

Real estate wholesaling investing offers newcomers a low-cost entry into property investment. The approach centers on negotiating discounted contracts and transferring them to end buyers for a fee. By focusing on contract assignments rather than property ownership, wholesalers avoid large down payments and ongoing holding costs. This strategy develops expertise in property valuation, persuasive communication, and contract management. Rapid transaction timelines often lead to immediate profits rather than waiting for property appreciation. However, success requires a reliable network of cash buyers ready to close deals promptly. Transparent dealings and fair offers build trust and a positive reputation in the market.

Advantages of the Wholesaling Investment Model

Wholesaling demands far less initial investment than purchasing rental properties or rehabs. Wholesaling provides a fast turnaround, often resulting in profits within weeks instead of years. The learning curve in wholesaling imparts critical real estate skills applicable to other investment strategies. Wholesalers are not burdened by ongoing repair costs or rental vacancies. Developing connections with industry stakeholders generates leads and partnership opportunities.

Profits from assignments can be reinvested into bigger projects. Predictable profits from contract transfers support sound budgeting and operational forecasting. Wholesalers can maintain liquidity, avoiding cash flow constraints common in traditional buy-and-hold strategies. One-time gains from wholesaling usually involve simpler reporting compared to regular rental revenue. Collaborating with veteran wholesalers through masterminds fast-tracks your skills and deal flow. Digital marketing and CRM tools can further enhance lead generation and follow-up efficiency. Utilizing expert-led resources strengthens your wholesaling skills and industry awareness.

For more information on investing in real estate wholesaling, go to: how to wholesale houses step by step

Essential Tools and Platforms

A robust CRM system centralizes leads and automates follow-ups, ensuring no opportunity slips through the cracks. Digital lead solutions aggregate data on absentee owners and pre-foreclosures, giving you a head start on potential deals. Automated profit models compute key metrics like cap rate and cash-on-cash return to validate deals fast. Electronic signing tools allow sellers and buyers to finalize documents instantly from any device. Email and SMS sequences tailored to seller profiles drive engagement and increase response rates. Title company portals provide real-time updates on closing requirements and fund transfers, helping you track each assignment to completion. Online real estate communities and local meetups match you with active investors ready to close quickly.

When used in concert, these resources automate the majority of your workload, freeing you to chase the best deals.

Initial Steps to Kick-Start Your Wholesaling Journey

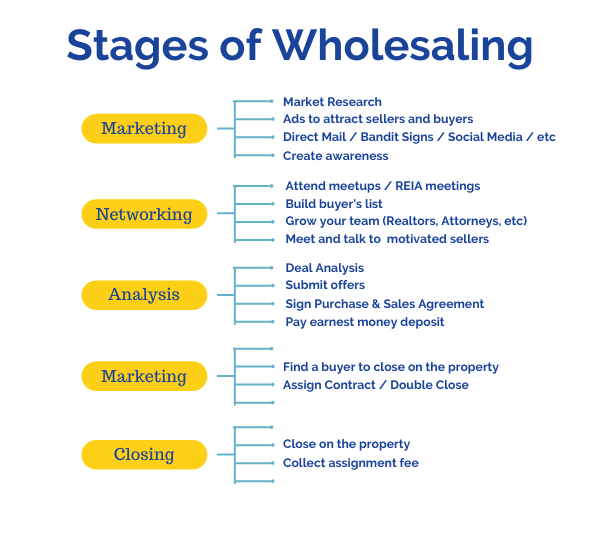

Begin by educating yourself on local market dynamics—study recent sales, price trends, and neighborhood developments. Compile a list of motivated seller leads through direct mail, bandit signs, and online advertising campaigns. Develop a simple contract template with an assignment clause, reviewed by a real estate attorney to ensure legal compliance. Practice your pitch and negotiation scripts with peers or mentors to refine your communication skills. Build your investor database through local meetups, LinkedIn outreach, and referrals from industry contacts. Automate lead responses and drip campaigns so that no prospect goes unattended. Finally, make your first offer on a well-researched deal, track your metrics, and iterate your process based on real-world results.

Typical Mistakes in Wholesaling and Their Solutions

Overestimating property values or ARV can lead to unprofitable deals—always verify numbers with multiple comps. Ignoring renovation budgets can turn a profitable contract into a loss—obtain accurate repair quotes upfront. A weak buyer pipeline increases assignment times—actively add new investors to your list each week. Skipping follow-ups allows motivated sellers to slip away—use CRM alerts to prompt timely engagement. Using DIY contracts without legal oversight may void assignments—ensure all documents are legally sound. Pursuing too many leads too quickly can overwhelm your processes—prioritize quality over quantity. Ignoring market shifts and economic indicators can render your strategies obsolete—stay informed and adapt accordingly.

Wrapping Up Your Wholesaling Investment Journey

Real estate wholesaling offers a practical, low-risk avenue for new investors to generate income and build expertise. By mastering lead generation, deal analysis, and negotiation, you lay a solid foundation for ongoing success. Integrating digital solutions for data management, deal modeling, and outreach accelerates your growth trajectory. Continuous education, ethical practice, and network expansion fuel long-term credibility and deal flow. Launch your first contracts, learn from each outcome, and deploy assignment fees to grow your wholesale enterprise. By staying disciplined and adaptable, wholesaling can evolve into a powerful pillar of your real estate endeavors.

Begin today, tap into expert guidance via wholesaling property, and build a thriving wholesaling business.